We Go Above and Beyond

Market leader in real estate acquisitions and property management which has delivered superior returns to our stakeholders for over 20 years.

Investors

|

Investment Allocation

STUDENT SECTOR

Purpose-built student housing investments currently represent the majority of HRA’s investment portfolio. We target investments that are pedestrian to campus and have best-in-class amenities including state of the art fitness centers, study lounges, pools and other recreational facilities.

Acquisition Criteria:

- $20M+ in Value

- 500+ Beds

- Power 5 Conference Schools Preferred

- Value-Add, Core, and Stabilized Assets

- Public Universities with 15,000+ enrollment

CONVENTIONAL SECTOR

Description – Conventional Multi-Family Housing is the largest sector within the Real Estate Investing Industry. These investments are generally considered the most stable assets, with an average of 95%+ occupancies nationwide over the past 5 years. These investments represent approximately 30% of HRA’s investment portfolio.

Acquisition Criteria:

- $20M+ in Value

- 200+ Units Value-Add, Core, and Stabilized Assets

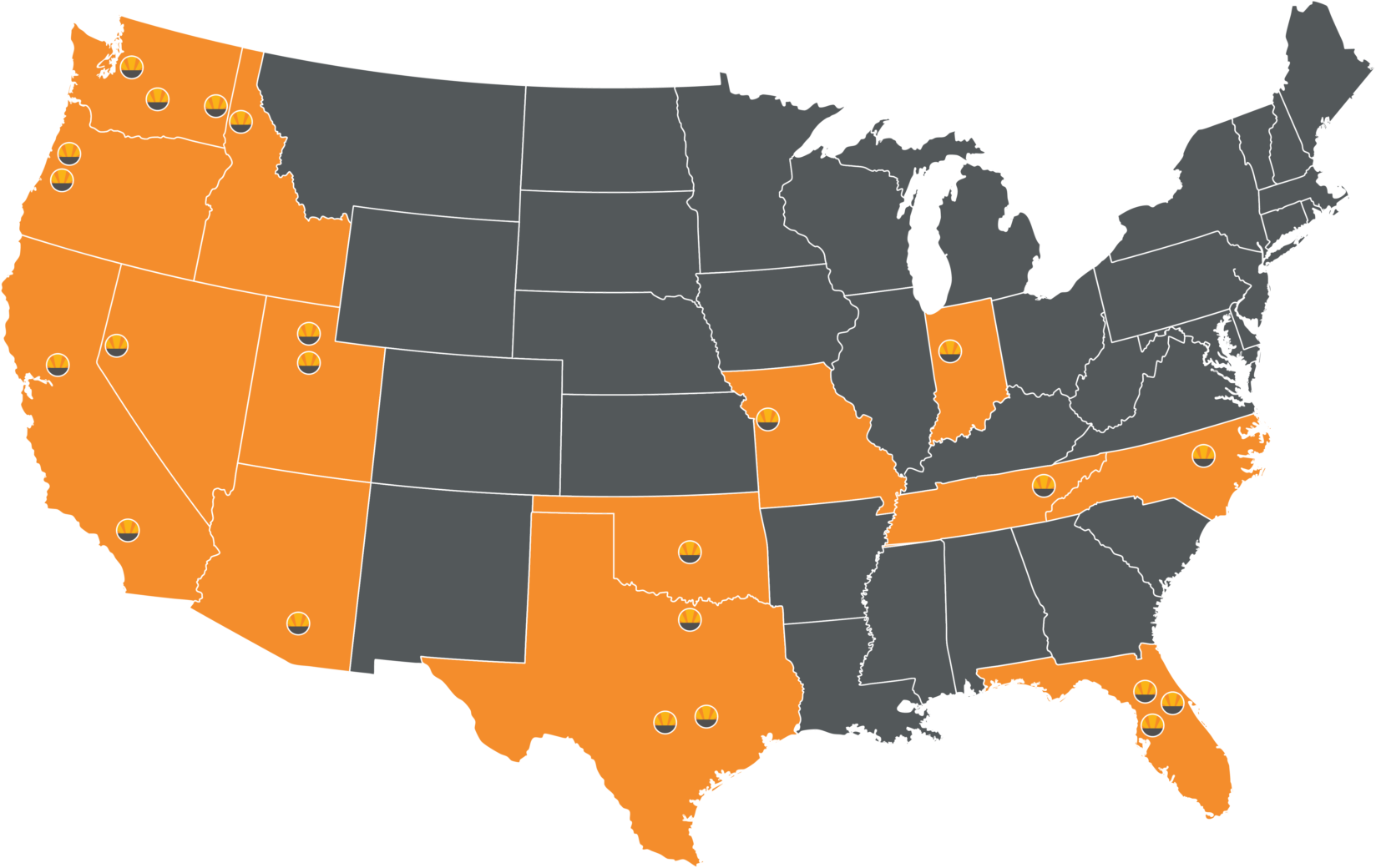

- Preference for Western United States, Texas, and North Carolina

HYBRID SECTOR

Description – Horizon has acquired several ‘Hybrid’ Apartment Communities, who cater to both conventional renters and students of major tier 1 universities. Horizon is able to leverage our management expertise in both of these fields to take advantage of the growing opportunity represented by this type of assets.

Acquisition Criteria:

- $20M+ in Value

- 200+ Units

- Located in markets that cater to conventional multi-family renters as well as proximity to major Public Universities (15,000+ enrollment)

- Value-Add, Core, and Stabilized Assets

Asset Classifications

Value Add

Value-add investments include assets that are well-positioned to increase cash flows through enhanced management and strategic capital improvement initiatives that drive rent growth. Horizon targets value-add investments in growing markets that may be traditionally underserved. This Asset Class typically requires intensive management and more robust capital infusion, however but also provides the potential for higher returns.

Core Plus

Core Plus properties tend to be well-located, relatively new buildings in markets that possess long-term positive growth fundamentals. These assets present an opportunity for increased cash flow through light capital improvements and operational upside. The risk and return profiles of these investments fall in-between those of Core Assets and Value-Add Assets.

Development

Development

Horizon has recently launched its very own ground-up development platform. Our first in-house development, The 446 in Pullman, opened in August 2019 and is currently more than 97% occupied. Additionally, construction is underway on The Flats at Chase, a 228-bed student housing community in Eugene, Oregon and C Street Suites, a 40-bed student housing project in Pullman. We see tremendous value in the ability to leverage our proven track record of management excellence with our own ground-up development channel.

Core

Core investments are considered to carry the least risk, as they generally consist of high-quality, well-located properties in desirable markets. These assets are usually newer buildings that require minimal capital improvements at the time of acquisition. Due to the appeal of these assets, institutional investors with lower return thresholds are very active in Core acquisitions, driving prices up and cash flow returns down, however the favorable location and quality of these assets typically results in steady, long-term appreciation.

Investment Advantages

FULLY INTEGRATED PLATFORM

Fully vertically integrated Real Estate Investment Platform with Strong Track Record of In-House Management.

ALIGNMENT OF INTERESTS

Horizon’s partners invest their own wealth into each deal, resulting in an alignment of interests that benefits investors.

INSTITUTIONAL EXPERTISE

By performing every aspect of investment management, from underwriting to operations to asset management in-house there are tremendous economies of scale realized and institutional knowledge cultivated.

DIVERSITY OF INVESTMENT TYPES

By investing across a multitude of Asset Classes, Investment Sectors, and our own In-House Development Pipeline we are able to offer a diverse selection of investments to our investors.

Testimonials

Brian Yates

“Investments are well thought out and thoroughly researched. They are honest and I trust them to take care of my investment dollars. HRA is a great way for me to diversify my portfolio.”

Bill Vansickle

“They have proven themselves to be experts in the sectors they invest, they have delivered returns commensurate or better than their pro-formas illustrated, they have been great stewards to the assets that have been purchased, and they offer favorable terms to investors.”

Bruce Kendrex

“I have been an investor in multiple HRA-lead investments over the past ten years. The factors that have led me to be a repeat investor are that its investment opportunities are structured and financed in a conservative manner, while still providing above-market returns.”